When I was still in school, I kept a "budget" my initial budget was really just a tally of what I spent and on what. For this is used a basic spreadsheet that was broken up into groceries, eating out, gas, clothes, and miscellaneous. Once I graduated, I started a pseudo-budget where I estimated what I was going to spend and then once or twice a month, I'd update to see how I was doing. This was the first iteration of our budget file.

When Tony and I bought our house, it was time to combine finances. For us, it was easier to take the money out of one account rather than figure out who would pay what when. (I know the "combine or not to combine finances" is a debate in its self. I am just saying what worked for us.)

Here's our budget template. There's one sheet for every month along with a summary sheet that Tony pulled together.

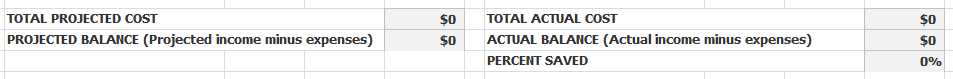

Here's a breakdown of what's on each month's page.

Income - It's set-up for two incomes

Total Cost - Summed from the info below

Household expenses - Mortgage, Taxes, and Utilities

Vehicle Expenses - Set-up for two car payments

Entertainment Expenses - Everything from Redbox movies to live entertainment

Food Expenses - Groceries to Work Lunches and Dining out

Personal Expenses - Cash for us to Personal Care Expenses

Vacation Expenses- Our expenses plus our puppy's costs

We're getting closer to using it as a real budget. We look at it at the end of the month to see where we can cut back. It's a work in progress but we're getting there. If the file doesn't download properly, leave your e-mail here and I'll send you the excel file.